Overview

The Debt Payoff Planner and Tracker application is a tool for helping you to become debt-free. It makes creating a debt payoff plan simple in order to encourage you to get started and stay on track. The journey to become debt-free can be daunting because of overwhelming credit card debt, car loans, taxes owed, medical loans, etc. The Debt Payoff Planner and Tracker breaks it down into simple, optimal steps that can be easily followed. This page is an explanation of the features of the Debt Payoff Planner and Tracker and how best to utilize this tool.

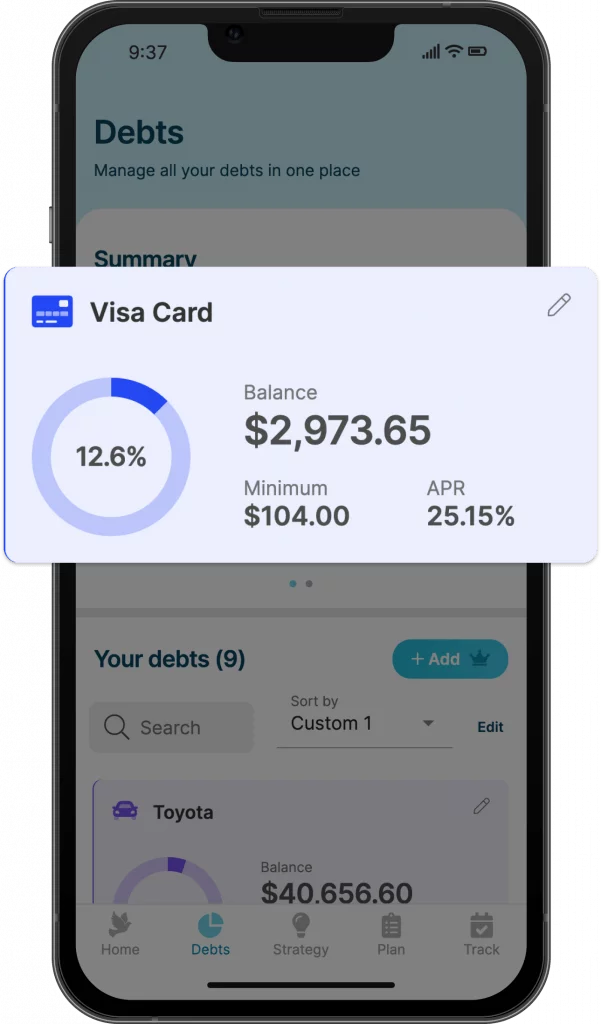

Debts

The Debts section of the applications is the list of all the accounts that need to be tracked. Each account will have a descriptive name for the account.

Balance of the account is equal to the initial account balance, less any recorded payments.

APR, short for the Annual Percentage Rate, is the interest rate of the loan. Promotional APRs are supported in Debt Payoff Planner.

Minimum is the Minimum Payment due for the account. The minimum payment is set by the credit card company based on your APR, your current balance, state and federal laws, and potentially other factors. It is assumed that you have enough income to cover all of the minimum payments for the debts.

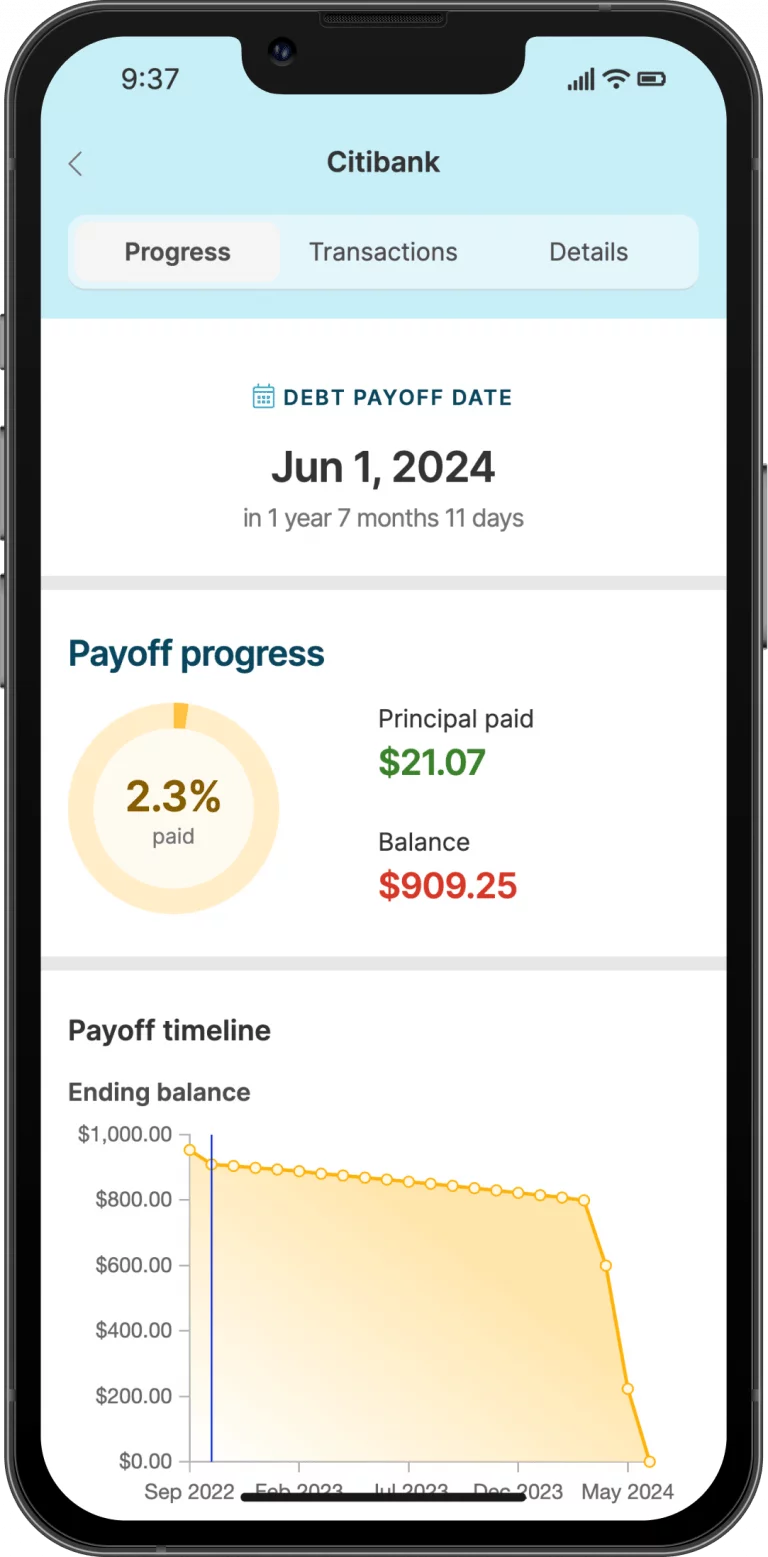

Payoff Progress is the percentage of the starting balance plus additional expenses that have been recorded in the Tracking page.

Clicking on the card will link to the Debt Details page including progress overview, tracking, and editing the details.

The pencil icon is a shortcut link to show the debt details which may be modified.

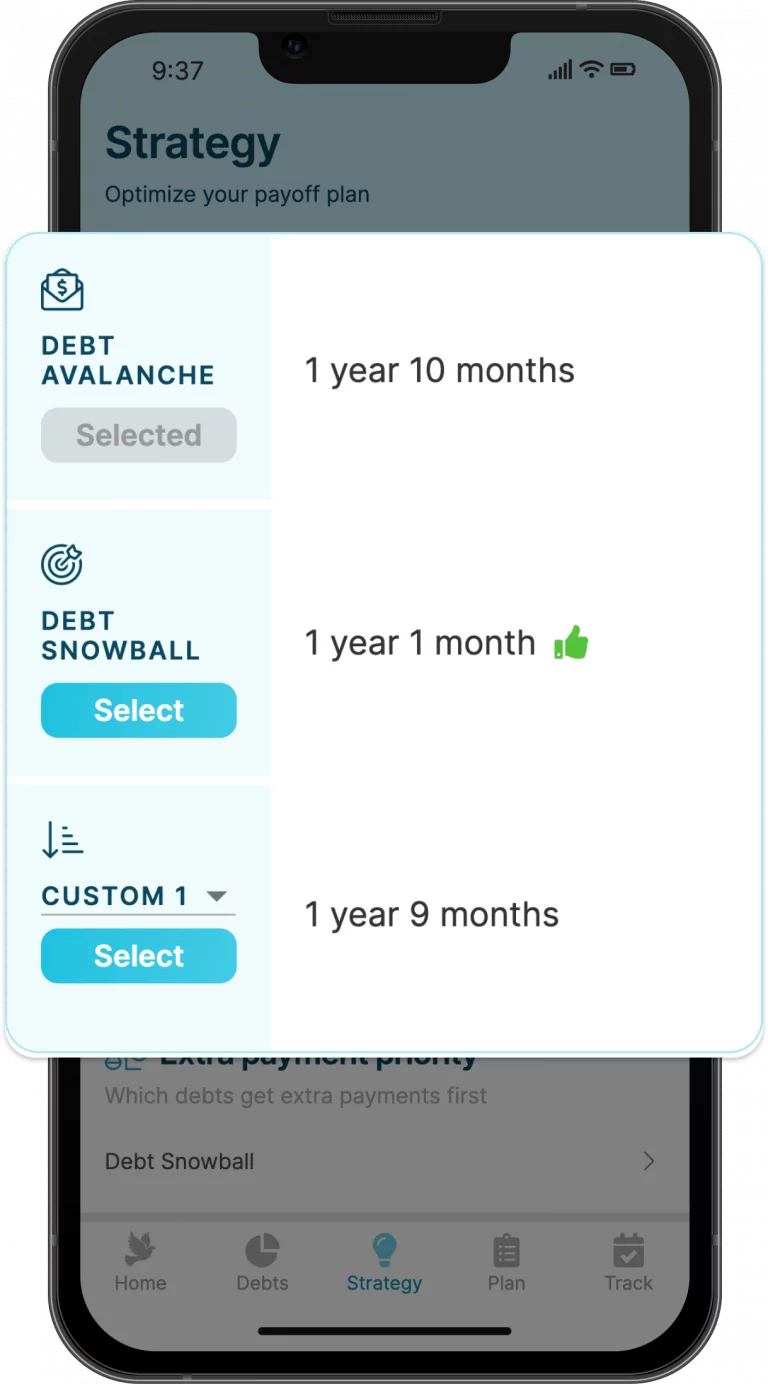

Strategy

The strategy section is the place to provide input on how you’d prefer to payoff your debts. This is the section where you can experiment with different payoff strategies and find a plan that suits you the best.

Recurring funding

Recurring funding total is the total amount of money that you’ll be applying to all of the debts every single month.

The Minimum is the total of all the minimum payments for the all of the debts combined. It is assumed that you are at least able to make all of the minimum payments, which is why this number cannot be modified. Once you’ve completely paid off a debt, the minimum payment of that debt will roll-over into the Extra amount which is paying off the rest of the debts at an accelerated rate.

Extra is how much additional money you can apply to paying off your debts above-and-beyond the minimum payment. This extra payment, which can be monthly or biweekly, is your most effective way to become debt-free the fastest. Experiment with the extra monthly payment to see how many months or years you can save with an extra $20, $50, or $100 per month.

Payoff Order

Payoff Order can be one of Debt Avalanche , Debt Snowball, or Custom.

The Debt Avalanche prioritizes paying off loans that have the highest interest rate first. Debt avalanche is the theoretically fastest way to payoff debt. By paying off the highest APR loans first you will always spend the least amount of money overall in interest assuming you stick with the plan. The downside of the debt avalanche approach is that if the loan with the highest APR also has the highest balance it may be a very long time before you see any significant progress in your debt payoff plan.

The Debt Snowball prioritizes paying off debts with the lowest balance first in order to have less bills to pay as you go. With the debt snowball you’ll most quickly be able to payoff one of your loans and be able to snowball that payment into the next lowest balance. The debt snowball is a great way to stayed excited about your debt payoff plan by getting some early wins and seeing the progress when you quickly have one less bill to pay.

The Custom payoff strategy will payoff the debts according to how they are positioned in the Debts section. You can set up to 3 different custom orderings and explore the payoff plan for each. This custom ordering approach may be preferred if there are certain debts that you need to payoff off the soonest despite the fact that they are neither the lowest balance nor the highest APR. An example of when this might be important is needing to pay back a relative that has loaned you money at 0% interest.

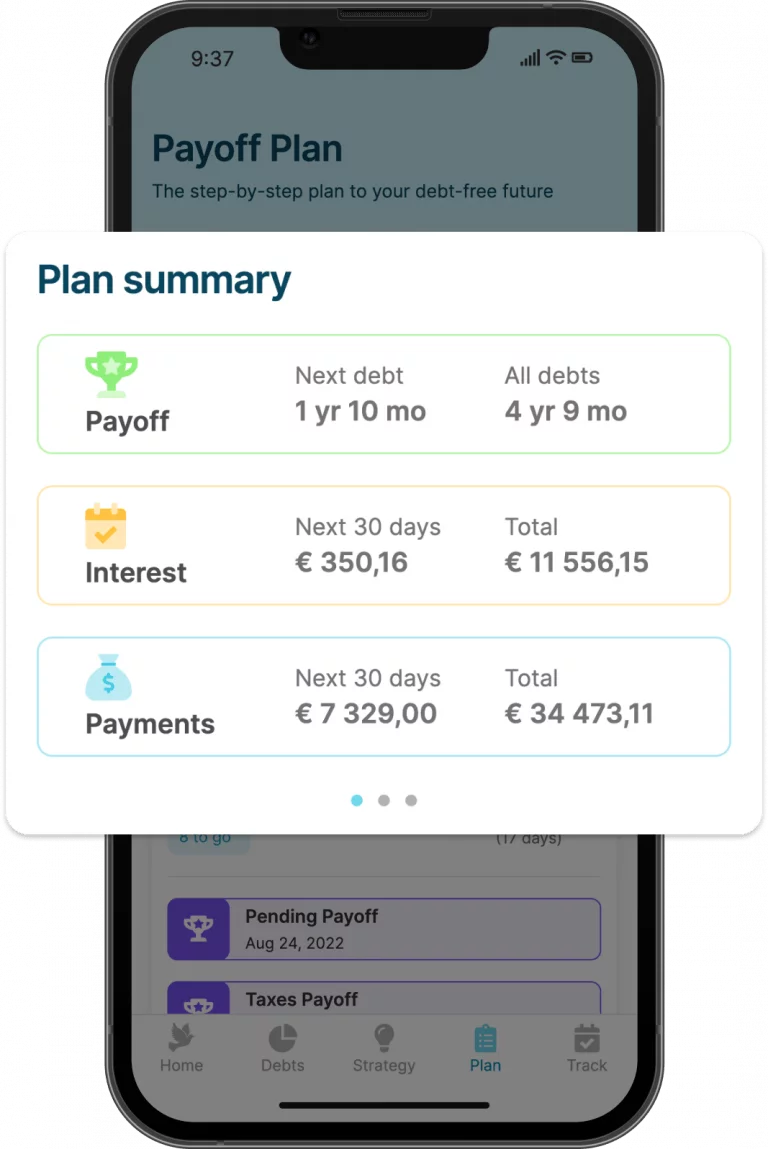

Plan Summary

The Plan Summary section on the Payoff Plan page gives you a high-level overview of all of the debts, balances, and when you can expect to be debt-free by sticking to a plan. When you experiment with the Strategy section, you’ll look at the Plan Summary to see the effect of the various strategies.

Payoff shows how long it will take to payoff the first debt and how long it will take to pay off all debts if you stick to the prescribed plan. The Home page shows the Debt-Free Countdown date and duration.

Interest: Next 30 days is the amount of money in the upcoming month that is used to service the debt. The difference between the monthly payment and the first month interest is how much is being applied to the principal of the loan. The monthly amount being spent on interest will go down as the current balance goes down. This means that over time more money will be applied to the principal each month and you’ll be paying off the loan faster over time.

Interest: Total is the amount of money that is paid to the creditors to service all of the debts. The strategy is to make the total interest as low as possible because this amount is going to the credit card companies, IRS, credit union, etc.

Payments: Next 30 days is the value of all minimum payments plus the extra monthly payment amount entered in the Strategy section. The monthly payment is how much money you are paying to service your debts each month. Think of it like this: once you are debt-free all of that money will go into your pocket!

Payments: Total is the total amount of money that it will cost to service your debt by the end of the debt payoff plan. The total payments include the principal value of the loan plus all of the accumulated interest.

Payoff Visualizations

Balance by category

The Balance by category pie chart on the Debts page shows the relative percentage of what types of loans you have. These categories are optional and can be see for each loan in the optional Debt Details section.

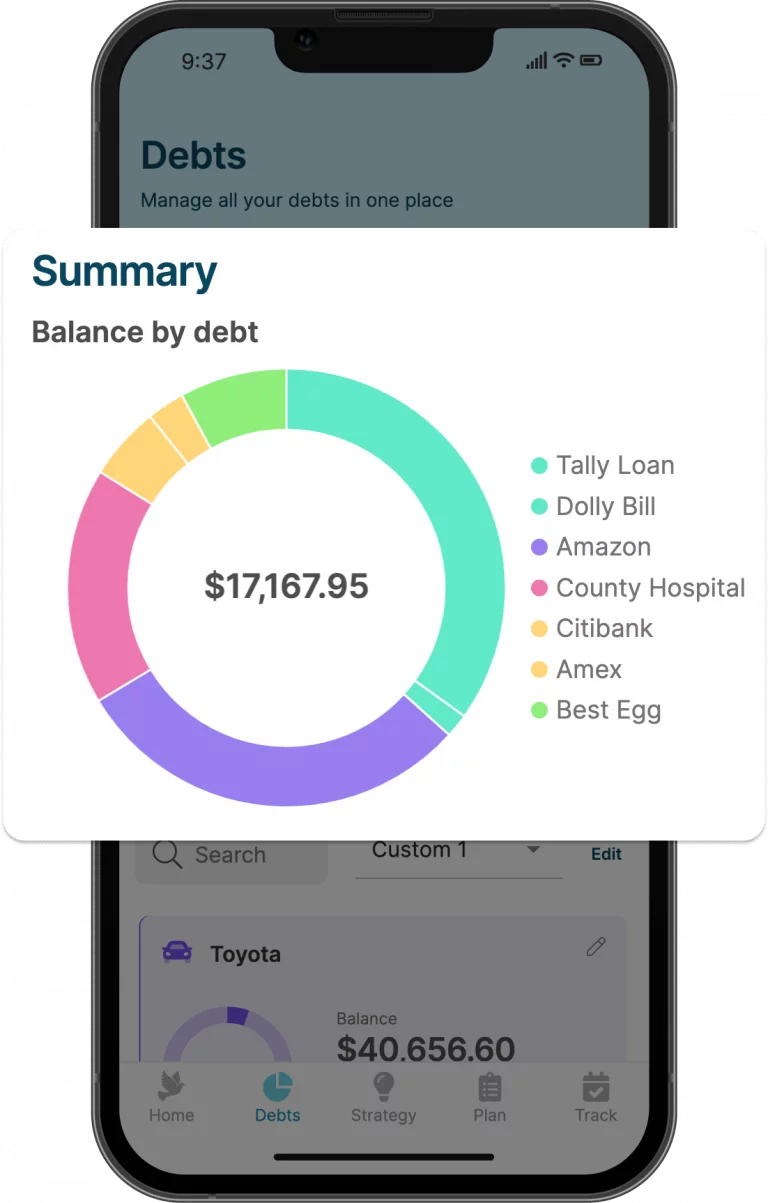

Balance by debt

The Balance by debt pie chart on the Debts displays each debt individually. Over time this distribution will change once the loans continue to be paid off.

Payoff timeline

The Balance, Balance by category, and Balance by debt name on the Home page each show a timeline of paying off the debts. This includes payments that have been tracked in the past and planned payments in the future.

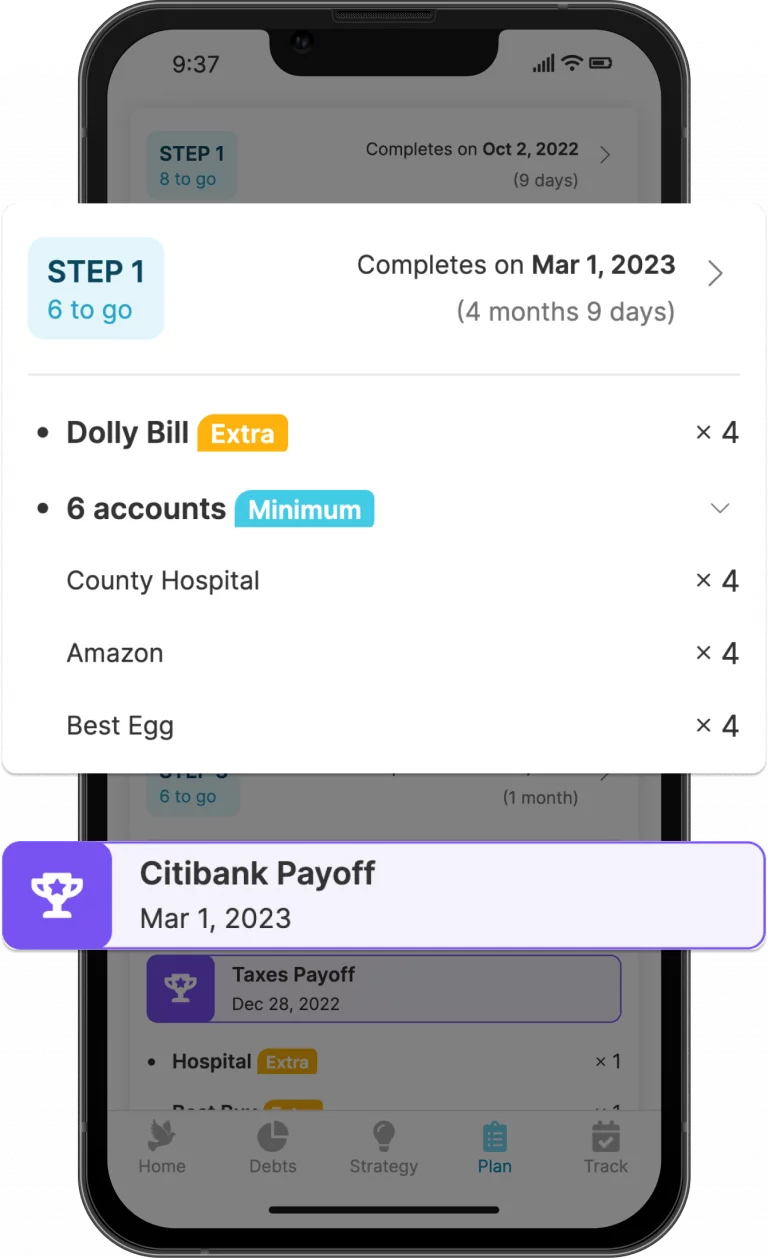

Payoff Plan

The Payoff Plan shows a detailed plan of how much to pay on each debt until you are debt-free. The bills can be due monthly, biweekly, weekly, etc. and the plan will tell you when each is due and how much to pay. The plan ensures that all of the minimum payments are being made and that the additional monthly payment is being applied according to your chosen strategy.

The Step is a way to track where you are in your plan. For a given step you will be making the same payment amounts on the specified debts each month. A step is generally focusing on what debt to make the extra payment, and all the remaining debts receive the minimum payment until one-or-more debts are paid off. Then a new step starts.

The completes on date is the date of the final payment that belongs to this step.

The x# next to the debt in the plan is the number of times to repeat the action, like make the minimum payment for 7 months as part of this step.

Each account will have a recommended amount to pay off debt according to the specified Strategy. The debt that will receive the additional payment beyond the minimum payment will be tagged as Extra. Everything else will be labeled as Minimum.

The Payoff shows when this loan will be completely paid off assuming that the recommended strategy is followed. All of the money that was being applied to that debt will be rolled-over in the next step to more quickly pay down the remaining loans.

Articles

The Articles section contains a number of posts to try and help you take your debt-free journey to the next level.

Debt Details

The Debt Details page is accessed by clicking on any of the accounts listed in the Debts page. This page has three sections: one for getting an overview of your progress on this debt, one that lists the upcoming and completed transactions, and one in which you can edit the details of the debt itself.

This page is how you update the detailed information about each debt, for example assigning a category to your debts in order to get a richer visualization on your charts.

Required Fields

Nickname is the name that will be used for this account throughout the application. The name should be unique so you’re able to distinguish between the various debts.

Current Balance is the amount owed on the after considering the initial starting balance and all payments that have been made and additional expenses that have been recorded. The Current Balance will be updated automatically as you record payments on your debt payoff plan.

Annual Percentage Rate is a number that represents how much you are paying your creditor in order to borrow money. This value can be found in your account statement.

Minimum Payment is the minimum amount you can pay on the debt every month without being changed late fees. This value is explicitly set by the credit card company. Debt Payoff Planner supports a fixed amount, percentage of principal, and percentage of principal plus interest.

Next Payment Due Date is the day, month, and year on which the payment must be made in order to avoid any late fees. The advantage of inputting the Payment Due Date is so you can have one place where you can quickly see all of the due dates.

Optional Fields

Category is where you can specify what type of account this is. In order to see the By Category pie chart in the Debts page should be filled in.

Optional Fields – credit card category

Network is the highest level credit card processor. For example Visa, MasterCard, American Express, Discover, etc.

Issuer is the company that provides the credit card. This could be a bank like Wells Fargo or a store like Home Depot.

Anniversary date is the month and day of the anniversary of the credit card. Because many credit cards have an annual fee on their anniversary date, it helps to keep track of when this is. You may want to transfer a balance and cancel the card before incurring a fee on the anniversary.

Annual fee is the amount charged each year for the ‘privilege’ of having the credit card. You can provide this information in order to track all upcoming fees and be able to plan for them accordingly.

Optional Fields – promo period

Promo period is a temporarily reduction in the annual percentage rate that is sometimes offered in order to incentivize people to sign-up for a credit card. If your account is offering a promotional APR check the box and fill in the details.

Promo Annual Percentage Rate is the temporary reduced APR that is offered during the promotion, expressed as a percentage. Oftentimes this is associated with a new account or a balance transfer.

Promo end date is the date in which the Promotional APR reverts to the regular APR.

Optional Fields – payment details

Minimum payment calculation is the method in which the payment is determined by the creditor. For example, most auto loans are a Fixed amount and most credit cards are a Percent of principal + interest

Payment frequency lets you specify when each minimum payment is due. For example, some bills are paid monthly on a specific day, some bills are paid every other week on a Friday.

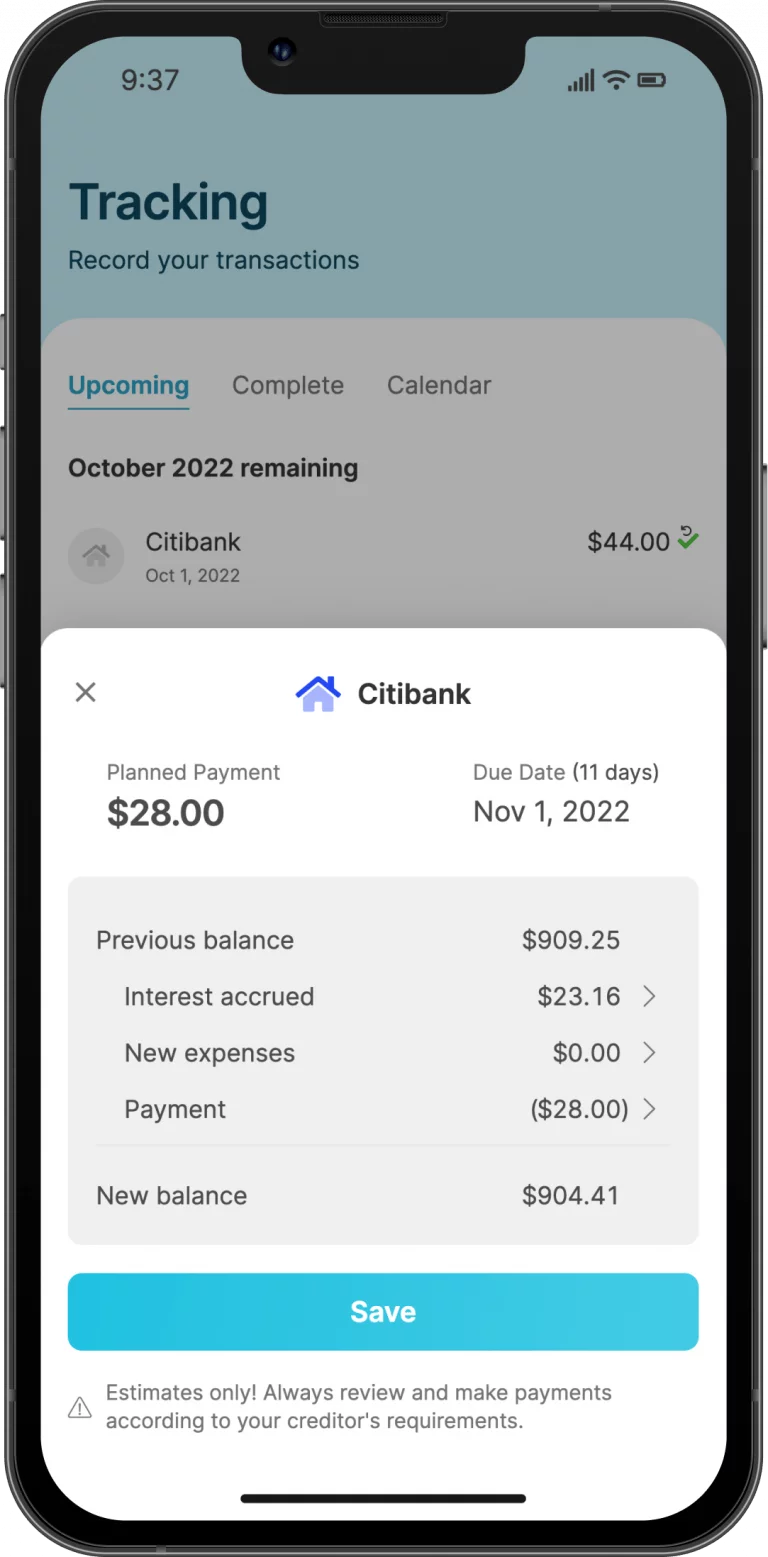

Tracking

The Tracking page is the place to record each payment for each debt. By recording a payment, the Payoff Summary, Current Balance, and Payoff Plan are updated to reflect the current balance.

Payment is how much was paid to the creditor. The default payment will be whatever should be paid according to the plan. If the actual payment made is different than the planned payment it can be easily changed and the plan will be recalculated automatically.

Each billing cycle the current balance of your debt will

- increase by

- interest accrued

- new expenses

- decrease by

- total payment to creditor

Bill Date is the date on which the payment is must be made without incurring penalties.

Transaction Date is the date in which the payment was made.

Interest Accrued is how much of the payment is being used to pay off the interest. The amount of the payment that’s being applied to the interest is computed automatically, but the exact interest accrued can be found on the loan statement itself.

New Expenses is the amount of any new charges to the account. This could be additional purchases, annual fees, late fees, etc. If you’re sticking to the debt payoff plan this number is ideally going to be zero each month, but realistically it’s important to have a place to put any new charges.

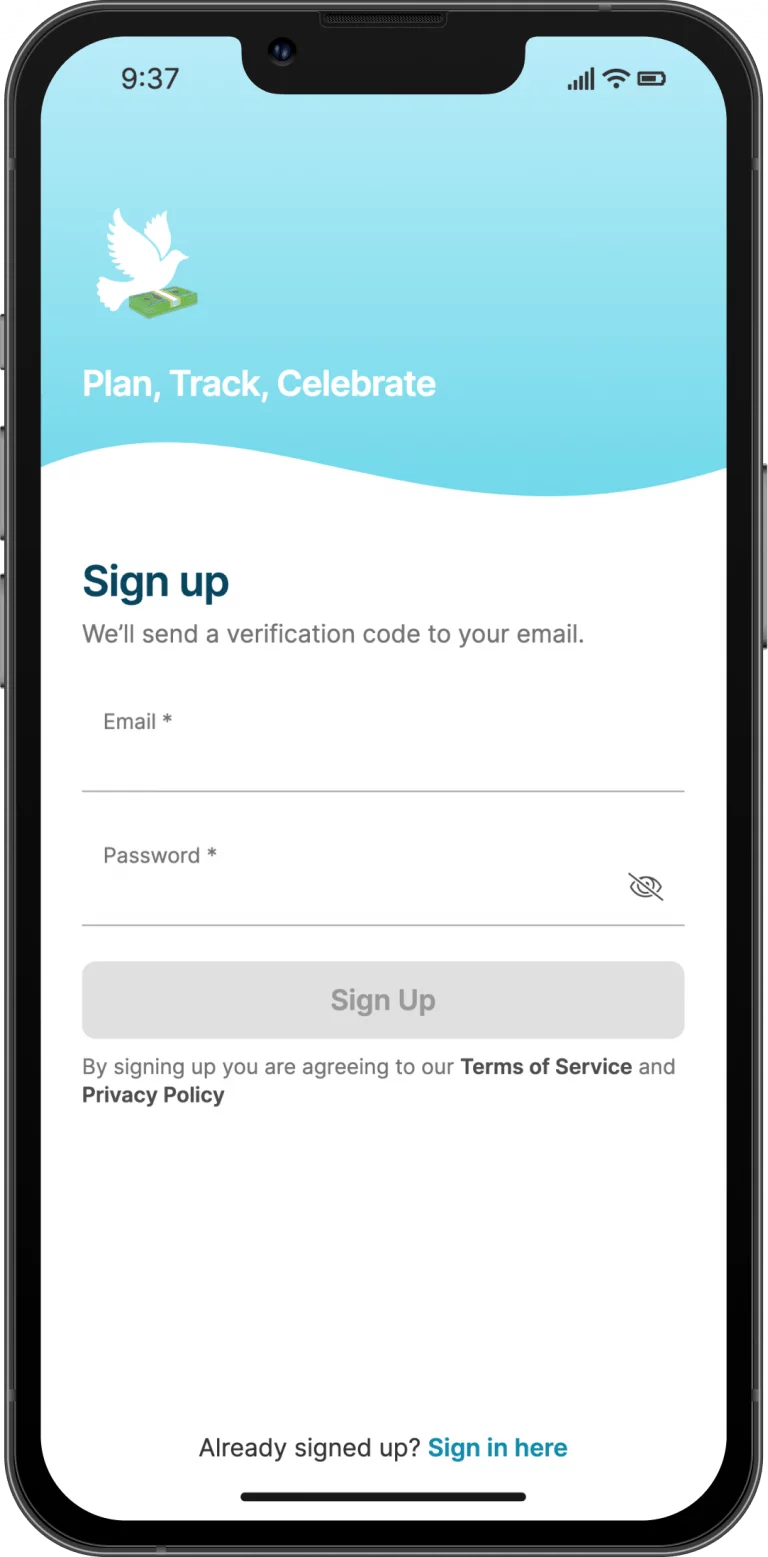

Create Account

When using the application for the first time you will be asked to create a new account. The advantages to creating an account includes access for multiple devices for Pro members, a secure login, and making sure your data is securely backed up.

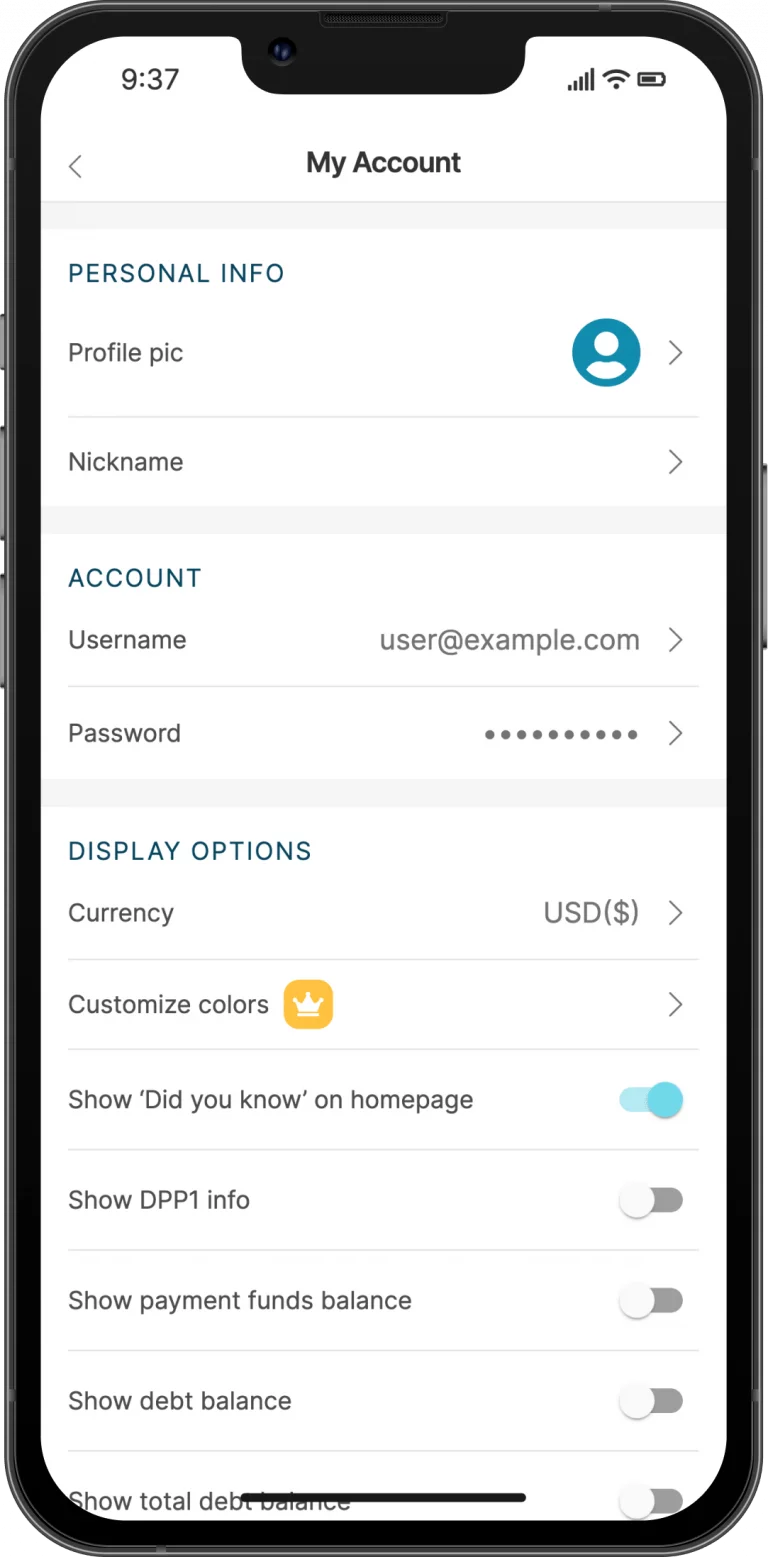

My Account

The My Account page contains information specific to your account. You can access the My Account page in the More menu, which is accessed on the top-right of the Home page or in the left-side menu on the web.