Debt Payoff Planner 2.0 Help

Debt Payoff Planner 2.0 Help

Table of Contents

App Walkthrough

Learn how to create a plan and track your progress with the new and improved Debt Payoff Planner

App Help and FAQ

Frequently Asked Questions

Desktop access is available at https://app.debtpayoffplanner.com/

Note that multi-device access (using both mobile and desktop) is available to Pro members

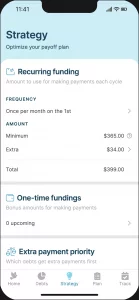

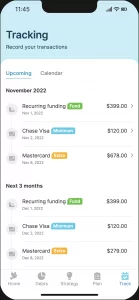

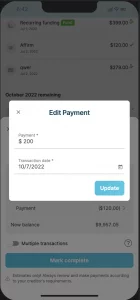

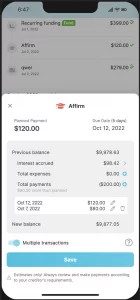

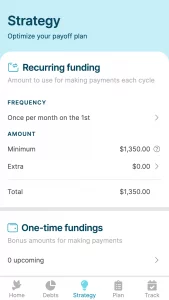

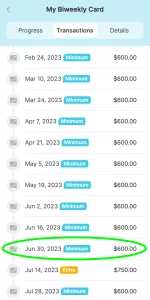

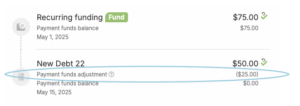

Recurring funding is the money that you’ll need to set aside to pay off your debt. Below is an example where the combined minimum payments of all debts is $365, and an extra $34 is being applied to the debts once per month on the 1st. This means that each month you’d need to set aside $399 by the 1st of the month. On the Tracking page, there is a transaction called ‘Recurring funding’ in this amount of $399 on the 1st of the month. Marking this transaction as complete is how we acknowledge that this money is available for the month to pay toward our debts.

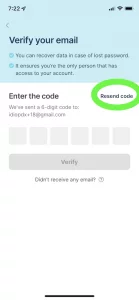

- Please check your spam folder and see if the email ended up there.

- There is sometimes a delay from the email sender and the email will show up within 5 minutes or so

- If you don’t see the email after 5 minutes, try to click the ‘Resend code’ link. Oftentimes it will show up on the second attempt.

- If you are still not seeing an email, contact us at support@debtpayoffplanner.com and let us know the name of your email address so we can help you out.

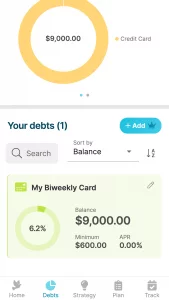

You can customize your extra payment priority by selecting one of the ‘Custom’ options in the ‘Extra payment priority’ page that is accessed from the ‘Strategy’ page. The actual custom order that corresponds to the strategy page is set in the Debts page. To change the custom priority, select ‘Custom’ from the ‘Sort by’ dropdown, ‘Edit’ the order, and drag-and-drop the debts. The debt in the top position will receive priority for the extra payments.

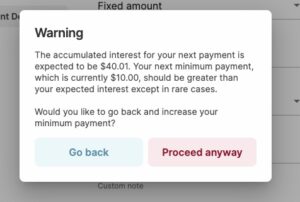

When you have a debt repayment plan where the specified minimum payments are insufficient to cover the accruing interest, the app automatically recalculates the minimum amount necessary to break even on paying off your debt.

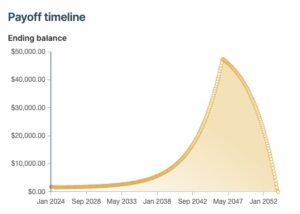

You can inspect the Payoff timeline chart in each individual account to see which ones have an increasing balance. This indicates that the interest is accruing in excess of the payment.

When you are adding or editing a debt that will have accumulating interest you will receive a warning dialog asking if you would like to proceed. Most of the time this situation is due to incorrect data entry.

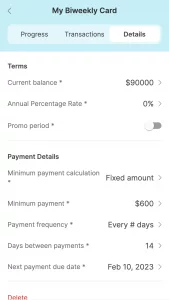

In some cases this situation is caused by a promotional APR and the Plan will still properly optimize for your chosen strategy. Promotional APRs often have a temporarily lower payment that will suddenly become much larger when the promo APR expires. Oftentimes people will specify their non-promo minimum payment in order to have a more realistic view of their debt payoff situation.

You are able to reset your forgotten password by accessing the ‘Forgot password’ link on the ‘Sign in’ page. You can get there by going to Settings -> Sign out and click the ‘Forgot Password’ link. This will send you an email you can use to reset your password.

Occasionally the internet can be a bit finicky and you’ll see an error that says ‘Houston we have a problem’.

- Try and close the app and reopen it

- Try to switch from WiFi to Cell data or from Cell data to WiFi

- Try to clear out your network settings:

- Turn off the WiFi and turn on airplane mode on the phone (so it’s completely disconnected from the internet)

- Close the app (hard close it, not just backgrounding it)

- Reopen the app (you should see an error about no connection)

- Turn on the WiFi and turn off airplane mode

- Reopen the app

- Clear out the Cache and Storage (on Android)Settings -> Apps -> Debt Payoff Planner -> Storage -> Clear CacheThis should remove any network settings that have gone stale.If that doesn’t work, try to clear all storage. Ensure you have a logged-in account to ensure all data is securely backed up. If you have any data in the old ‘Guest’ account (this is not typical), you’ll need to convert that to a logged in account first.When you are ready:Settings -> Apps -> Debt Payoff Planner -> Storage -> Clear Storage

- Try to wait a couple of days. We know this is frustrating, but most of the time it has to do with some configurations being set incorrectly somewhere in the internet and these get refreshed after a couple of day

This is the magic of the snowballing your payments when you pay off each debt! With Debt Payoff Planner once one debt gets paid off, that amount will go towards paying off the other debts faster. Because this snowballed amount is always in addition to the minimum payment, you are paying directly on your principal. Thus it’s common to see the case where you add your first debt and your payoff date is in 2 years, but when you add a second debt your payoff date for both is in only 1 year.

At this time Debt Payoff Planner does not account for additional fixed costs associated with mortgages. You’ll want to exclude the escrow payment amount (taxes, insurance, and PMI) from the minimum payment amount you enter into DPP.

DPP always processes debts before fundings in order to guarantee that money will be available to make the payment.

If a one-time funding is on the same date as the debt which is the priority of the strategy, the app assigns the one-time funding to the subsequent payment for that debt. For example, if a one-time funding is scheduled for March 1 and the priority debt is also scheduled for March 1, the plan will recommend paying the extra on the debt on April 1.

If a one-time funding occurs prior to the first recurring funding, and there are payments to be made on debts prior to the first recurring funding, the one-time funding may be used to pay toward those debts. In this event, you may not be able to see where the one-time funding is applied because it is being used to fund the minimum payments.

You may have a DPP2 account that is not up-to-date with the latest DPP1 data. If you want a fresh migration of your DPP1 data into DPP2, you can go to Settings -> My account -> Delete account (at the bottom of the page) and delete the DPP2 account. Now go to the Sign-in page and sign-in using your regular DPP1 credentials. When it asks how you’d like to handle your existing DPP1 account, choose ‘Migrate’. Now you’re all up-to-date.

Please note that DPP1 and DPP2 do not sync. If you have made changes in DPP2, these will not show up in DPP1. This should be considered before deleting the DPP2 account in order to migrate the data again.

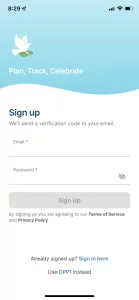

- On the ‘Sign up’ page click the link at the bottom of the page that says ‘Use DPP1 instead’ and confirm the selection by clicking the ‘OK’ button.

- If you are already signed in, you can go to the ‘Settings’ menu and click ‘Sign out’. This will take you to the ‘Sign in’ page. Click the link at the bottom of the page that says ‘Sign up here’ to navigate to the ‘Sign up’ page.

Debt Payoff Planner account deletion instructions:

- Navigate to the ‘My account’ page which is a menu option inside the ‘More’ page.

- Scroll to the bottom of the page and click the ‘Delete account’.

- Type in your password and press the ‘Confirm Password’ button in order to delete the account. If the password is unknown you can sign out of the application and click ‘Forgot password?’ on the ‘Sign in’ page in order to set a new password.

- You will be asked for one final confirmation. Note that this deletion is permanent and cannot be recovered.

- Data which will be deleted includes all account data and all user inputted data. The only data which is retained is the purchase information for Pro members such that they may continue to have access to paid features should they so desire.

- Account deletion will propagate to any existing data backup according to the backup schedule.

You can share a membership by clicking into My membership and add their email in one of the four Available to share slots. They’ll need to sign-up for a free account before you share. There isn’t going to be an automatic notification of the sharing, but if they have a free account they will receive the upgrade. I’ve included an image below to show you.

Contact Us

If you have any questions, comments, or suggestions, please email our support team at support@debtpayoffplanner.com and we will get back to you promptly